Here's all you need to do:

Step 1: Add products to your cart.

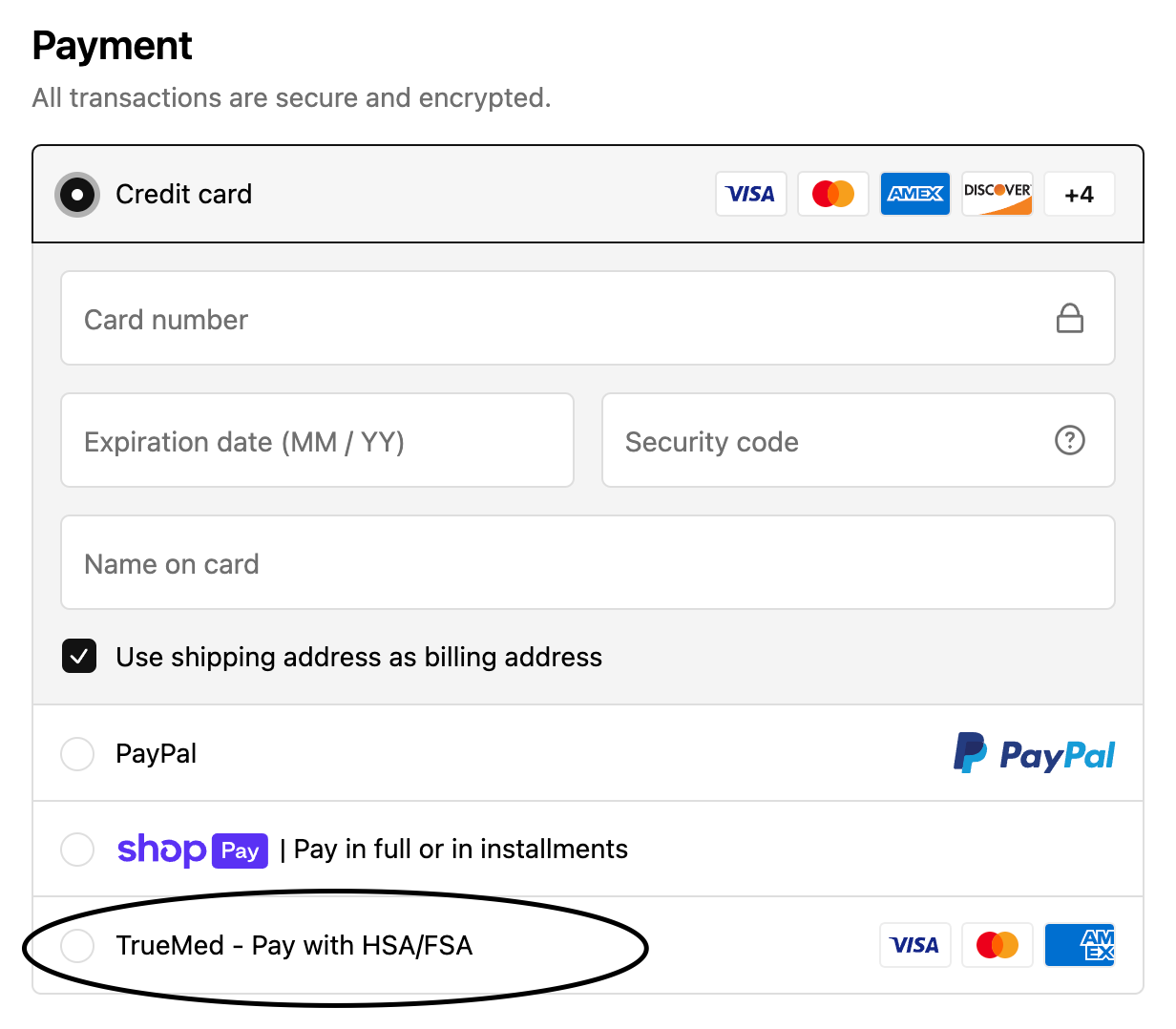

Step 2: Ensure you are not signed into Shop Pay or any accelerated checkout options.

Step 3: Select TrueMed® as your payment option at checkout (see image below).

Step 4: If you pay with your HSA/FSA card, there's no other work you need to do (we'll send paperwork to ensure compliance). If you pay with your personal credit card, TrueMed® will send reimbursement instructions.

The TrueMed® payment option determines eligibility and enables qualified customers to pay with their HSA/FSA funds at checkout. Once you're approved, that's it! You'll receive an order confirmation and effectively save up to 30-40% off your order!

Choose to pay the full amount via your HSA/FSA funds or pay a partial amount with the balance against your debit or credit card.

Shop Osone with HSA/FSA

At Osone®, we believe in the benefits of Cold Plunging and our partners at TrueMed® agree. Eligible customer can now use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on Osone products. This means you may be eligible to buy your favorite Cold Plunge with pre-tax dollars, resulting in net savings of 30-40% (based on your marginal tax rate).

HSA & FSA were created for you to spend tax-advantaged dollars on products and services that can treat or prevent medical conditions. TrueMed® is making it easy to do just that.

FAQ

Can I use my HSA/FSA card?

Yes, if you have a FSA or HSA card, this is the fastest way to checkout. Simply select TrueMed® as your payment option at checkout and use your FSA or HSA card as you would any other credit card.

Can I pay a partial amount with my HSA/FSA account and pay the balance with my debit/credit card?

Yes, customers can now pay a partial amount with their HSA/FSA funds and the balance with a personal debit/credit card.

Can I use my regular credit card at checkout?

Yes, if you prefer to use your regular credit card, TrueMed® will send you instructions on how to submit for reimbursement from your HSA/FSA administrator.

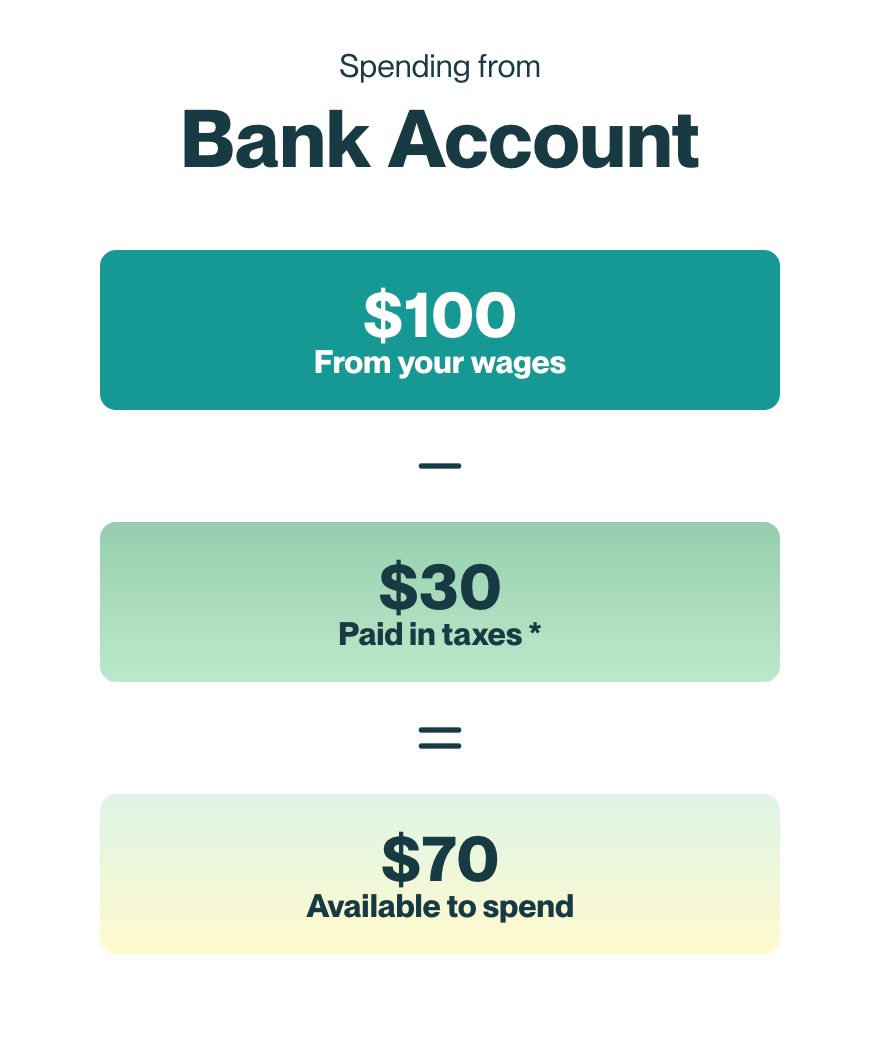

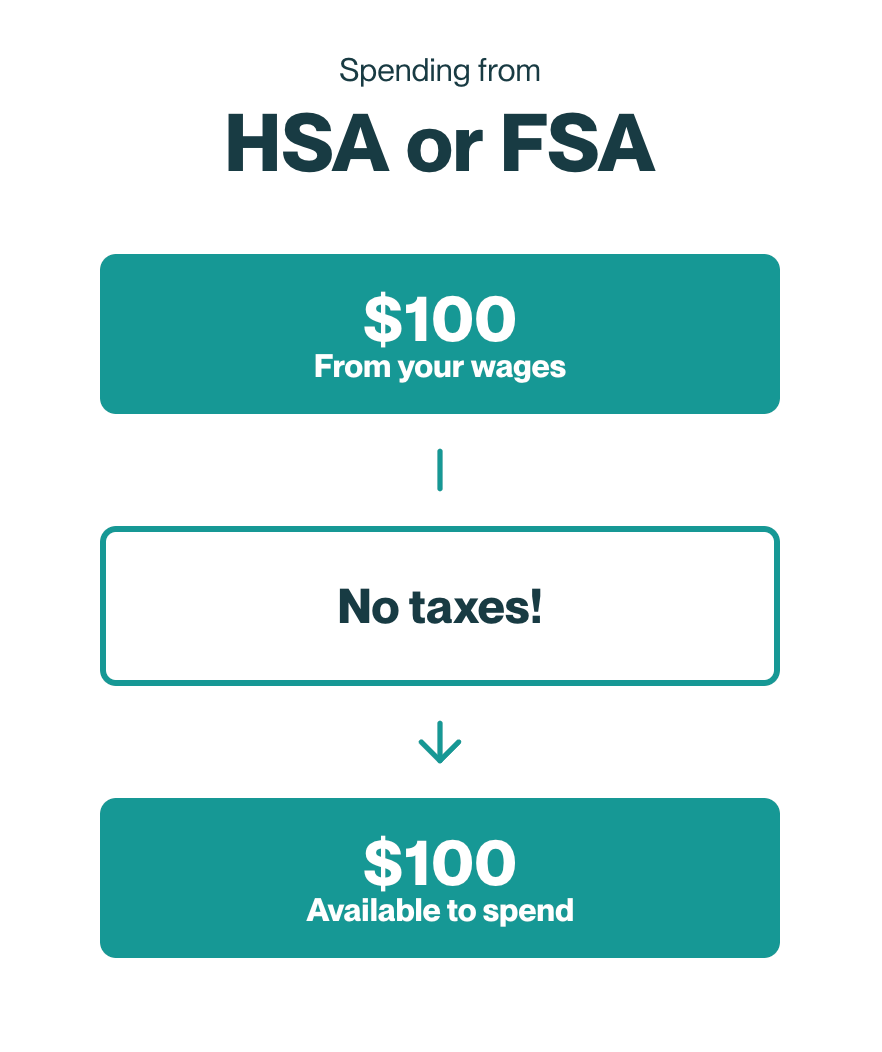

How does using my HSA/FSA account save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

Are there fees associated with using TrueMed® services?

There is no cost to you, as long as you are shopping with a TrueMed® partner merchant.

What Information Do I Need to Provide to Get a Letter of Medical Necessity?

When applying for a Letter of Medical Necessity, you'll need to supply some essential details. This process typically involves a few critical steps to ensure that you’re eligible and that the information is secure and accurate.

Here’s what you need to provide:

1. Personal information: This includes your full name, contact details, and date of birth. These basics help confirm your identity and start your application process.

2. Medical Symptoms and History: Clearly describe the symptoms you are experiencing. It’s also vital to include relevant aspects of your medical history, as this provides a complete picture of your health needs.

3. Verification of Identity: To ensure your identity is correctly recorded, you’ll be asked to verify your phone number. Additionally, uploading a photo ID is part of the process to ensure the integrity and security of your application.

Rest assured, all the information shared during the application will remain confidential, utilized solely by healthcare professionals involved in your assessment.

How to Purchase with a Letter of Medical Necessity?

Once you've secured a Letter of Medical Necessity (LMN), you're just a few steps away from completing your purchase. Follow this guide to ensure a seamless transaction.

1. Select the items you would like to purchase, add them to your cart, preparing for checkout.

2. Use your HSA or FSA card to complete your purchase. For a smooth process, make sure to use the same email address you provided when obtaining your LMN. If your HSA/FSA card isn't on hand, you can still pay with a debit or credit card. Post-purchase, you may need to apply to your HSA/FSA administrator for reimbursement.

3. Upon completing your purchase, you should receive a receipt and a copy of the LMN via email. These documents are crucial for substantiating your purchase.

4. Finally, log into your HSA/FSA administrator's website to upload the receipt and LMN. This step is essential whether you paid directly with your HSA/FSA card or intend to request reimbursement after using a debit or credit card.

By following these steps, you can efficiently utilize your Letter of Medical Necessity to make a purchase with ease.

How to Submit Your Letter of Medical Necessity for HSA/FSA Reimbursement?

When you've made a purchase that needs to be justified via a Letter of Medical Necessity (LMN) and paid using your Health Savings Account (HSA) or Flexible Spending Account (FSA), follow these steps to ensure a smooth reimbursement process:

1. Start by logging into your HSA/FSA account on the website of your benefits administrator.

2. Once logged in, locate the section dedicated to Reimbursements or Claims. This is where you'll manage document submissions.

How long does it take for me to receive my Letter of Medical Necessity?

Generally it takes 24-48 hours. In some cases, TrueMed® provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

Why Do I Need a Letter of Medical Necessity for Certain Purchases?

Using Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA) funds for certain products requires documentation beyond a simple receipt. This is where a Letter of Medical Necessity (LMN) comes into play.

Understand the Criteria

For a product to be eligible for HSA/FSA funds, it must be tied directly to a medical need. Items like bandages easily qualify because they serve clear medical purposes. However, some products fall into a "dual-eligible" category, meaning they can be used for general wellness or for a specific medical condition. In these cases, without an LMN, it's not evident whether the purchase is for a medical necessity or just personal well-being.

Real-World Examples

Consider iron supplements. Many people take them for overall health, but for someone with anemia, they become medically necessary. With a healthcare provider's recommendation outlined in an LMN, the purchase becomes eligible for HSA/FSA reimbursement.

The Role of Healthcare Providers

An LMN is essentially your healthcare provider’s note that justifies the medical purpose of the product for your specific condition. This official document bridges the gap, demonstrating necessity and paving the way for you to use your HSA/FSA funds wisely.

In summary, an LMN is crucial because it ensures that your purchases align with the intent of these healthcare accounts, focusing on genuine medical needs rather than general health pursuits.